Get Clear on Your Finances with Expert Bookkeeping and Cash Flow Strategies

You didn’t start your business to track expenses and decode GST rules. At Maple & Main Co., I turn messy books into meaningful numbers so you can make smart decisions, stress less, and stay ready for whatever comes next.

You can be the kind of business owner who actually feels calm about their books.

No more winging it. No more spreadsheets held together with duct tape and good intentions.

You don’t need to love numbers. You just need someone who does (hi, that’s me).

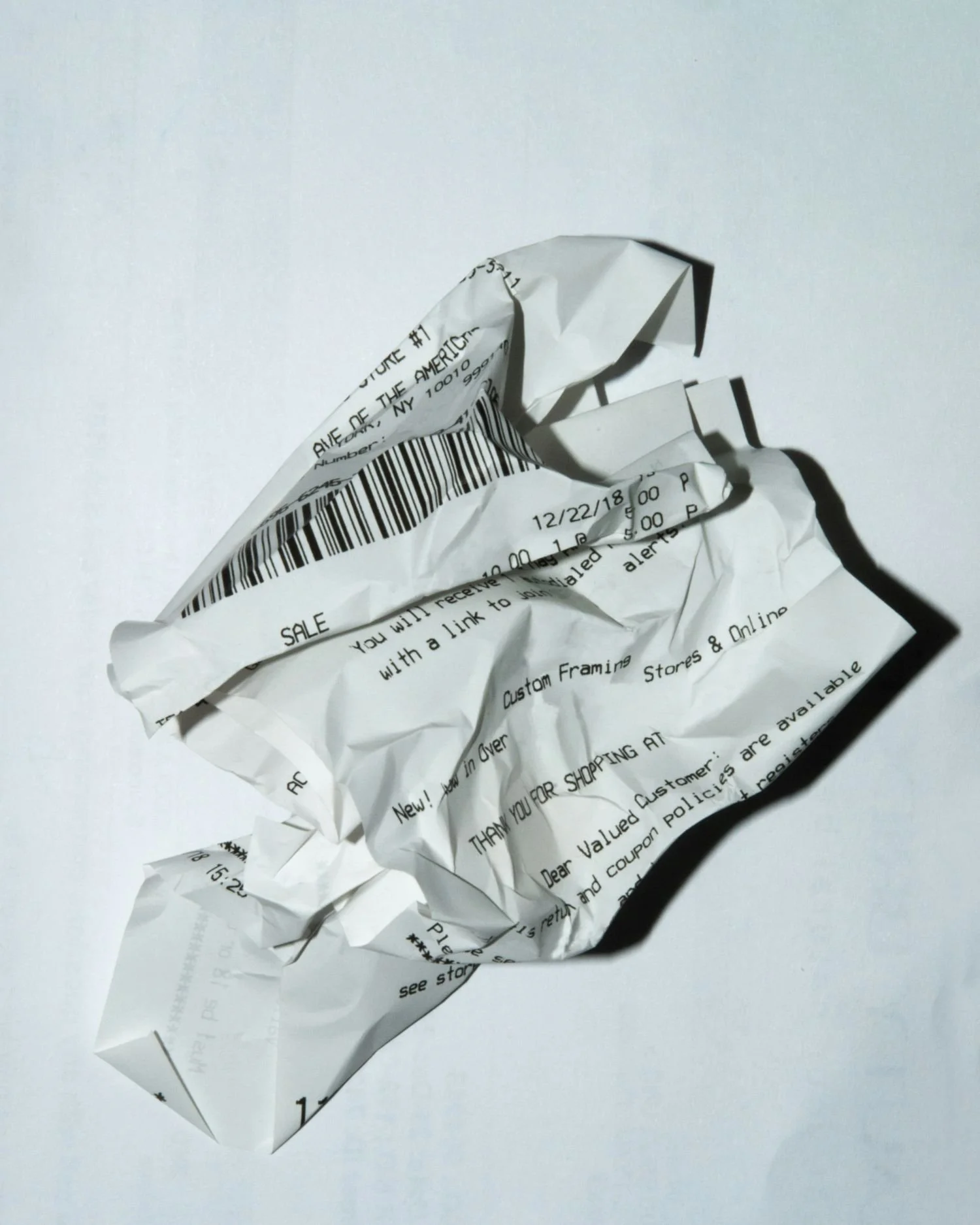

If you’ve been stuffing receipts into a drawer, crossing your fingers come tax time, or silently praying your bank account tells the whole story… you’re not alone. Most of my clients come to me mid-facepalm, wondering how it got so messy.

You’re running a real business, juggling real life, and you deserve better than financial guesswork.

At Maple & Main Co., I help folks like you go from scattered and stressed to steady and clear. I bring calm to the chaos, clean up the mess, and build systems that actually work—for you, not just your accountant.

Because you don’t need to do it all. You just need to know it’s handled.

We work with…

Farmers/Ranchers

Creative Service Providers

Energy Healers

Business Coaches

Life Coaches

Naturopaths

Homeopaths

Personal Trainers

Tradespeople

Yoga Studio

Holistic Healers

Photographers

Reiki Masters

Artisan Soap/Skincare Makers

Herbalists

Catch-up/Renovation

Need to get your books back on track? Catch-up bookkeeping gets your financial records organized and up-to-date so you can confidently move forward. I'll tackle those overdue tasks, fix any errors, and prepare you for a stress-free tax filing.

>> Assess current financial records and bookkeeping

>> Review/adjust chart of accounts

>> Categorize/reclassify transactions

>> Reconciliation of each month to date

>> Provide up-to-date financial reports

>> Communication and collaboration with your accountant

Monthly Bookkeeping

Monthly bookkeeping keeps your financial records accurate and organized, giving you peace of mind and the insights you need to make smart business decisions year-round.

>> Data entry for day-to-day transactions

>> Bank and credit card reconciliation

>> Preparation of financial statements

>> Sales tax reconciliation and filing

>> Communication and collaboration with your accountant

Done-For-You QBO Set-Up

Start fresh with a QuickBooks Online setup that actually makes sense for your business. I’ll build you a custom chart of accounts, connect your bank feeds, set up taxes, and make sure everything is ready to roll—so you don’t have to waste time Googling what a “chart of accounts” even is.

You’ll walk away with a clean, organized file and the confidence to move forward (plus a little training so you know where to click without breaking anything).

DIY QBO Set-Up Guide

Prefer to roll up your sleeves and do it yourself—with a little guidance? This step-by-step setup guide walks you through getting QuickBooks Online up and running without the overwhelm.

Perfect for small business owners who want to keep control of their books but need a little help making sure it’s done right the first time. No jargon. No guesswork. Just clear steps, real talk, and a setup you can trust.

Well hey, I’m Amy!

I’ve been doing this for 19 years, and no, I still haven’t gotten bored of balancing books (weird, right?). I’ve worked with farms, studios, spiritual businesses, product makers—you name it. And whether you’re dealing with missed HST filings or mystery transactions from three months ago, I’ve probably seen it… and cleaned it up with zero judgment.

I get how overwhelming finances can feel when you’re the one wearing all the hats. That’s why I don’t just file things and bounce—I bring structure, systems, and a little peace of mind to the whole dang process.

I work with clients who care about their business, want things done right, and appreciate a bookkeeper who knows her stuff, doesn’t sugarcoat things, and might just send a reminder with a goat gif.

If you’re ready for clarity, consistency, and someone who genuinely gives a hoot—you’re in the right place.

I’m not just your bookkeeper—I’m your behind-the-scenes business partner.

Know what you can write off—without second-guessing.

Grab my free checklist made for Canadian small business owners who want to keep more of what they earn. It’s clear, quick, and full of “ohhh, I didn’t know I could claim that!” moments.

You run the business. I’ll keep the books steady. And we’ll both sleep better at night.

Sound good?